“Composable or De-composable” – The convergence of Digital Experience Platforms (DXP)

Digitalizing your sales strategy is a prerequisite in becoming a true digital business. However, this is more complex than it looks from the outset and requires more than just a nice-looking marketing or e-commerce website.

Have you yet to digitalize all your customer-facing activities? Do you have systems in place (CMS, e-commerce platforms) but still struggle to get the digital channel performing? You know you must focus on customer experience, but you are not completely sure where to start.

Such transformations are all about building a unified experience across all your customer journeys, which is the mission of a Digital Experience Platform (DXP). Agreed. But what is best for your business: to buy a DXP or to develop one on your own?

This choice is quite stark: either buy one of the all-in-one Gartner Magic Quadrant DXP leaders or assemble your own set of components to build the Digital Experience Platform uniquely suited to your needs. This may be seen as a classic “Build or Buy” dilemma but it is this investment probably more than any other that will be the backbone of your business so there’s a lot riding on the decision.

Perhaps it ought to be more a “build more than you buy” vs “buy more than you build” question.

In this blog post I share some insights around the topic of Digital Experience Platforms (DXPs) and the key trends associated with this fast-evolving market. I hope it can be helpful for you in assessing which way you should go.

The paradox of the DXP market

The rise of DXPs is directly related to Digital Transformation which is all about breaking silos. This forces companies to integrate (both technologically and organizationally) all parts of their business. On the technology side, the complexity and the costs of integrations have created two important forces that are ever present in the Digital Experience market today:

- The consolidation of software vendors from the CMS, e-commerce, and Martech markets to deliver all-in-one DXPs. Many CMS-leading vendors such as Adobe, Sitecore, Episerver (recently rebranded as Optimizely), and Acquia have evolved in this direction to deliver more than just marketing engagement through content and provide sales and after-sales tools integrated within one platform. Such a “two-in-one” approach seems to make sense for business buyers looking to unify the visitor experience across all touchpoints of the customer journey. Typically, they are costly. They tend to be either “monolithic” or, as the result of acquisitions, an imperfectly integrated collection of different software tools. Either way, they usually need a fair amount of customization which slows down time-to-market and business agility.

- The MACH trend where MACH means Microservices API-First Cloud Native Headless (this is very much related to the microservice trend in the IT industry), where more specialized vendors deliver better interoperability for faster and less expensive integrations. The value here is clear: you can select only the components you need for your business, and quickly integrate them with the help of front-end developers. This is less unified than an off-the-shelf platform but can be very powerful and useful from an agility perspective.

In short, we see a consolidation on one side and a fragmentation on the other (or MACHification). Now, let me add more nuance or granularity to this observation. It’s too simple just to say that some all-in-one DXPs are more monolithic than others while some headless vendors are more fragmented/isolated than others. Put another way, headless technology providers are to a greater or lesser extent packaging their capabilities. Some are low level with very technical components while others have already added some business coherence which can be seen as business components. This distinction in terms of granularity is what Gartner explains by using the term Packaged Business Components (PBCs).

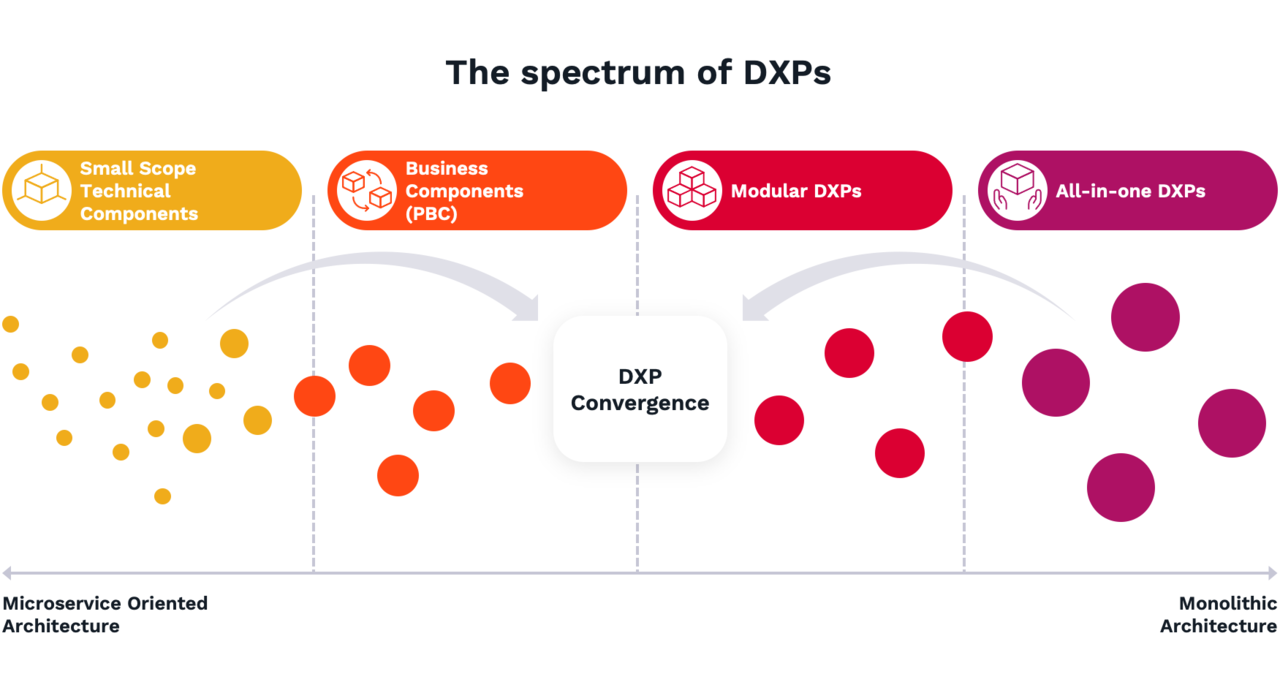

So let us look at the diagram below to understand these nuances and predict some of the market dynamics.

For me, the diagram above is both a picture of the current situation in the market as well as a prediction (the arrows) of how this market will evolve. Of course, we are simplifying somewhat to understand the bigger picture, but you find the coexistence of the following players (from large to small):

- All in-one DXPs, often the leading DXP giants of our industry with a very broad scope of features and capabilities but which are often slower to implement and very costly.

If it ticks all the boxes and your business processes are not too complex, this can be a good solution

Examples: Adobe AEM, Optimizely, Sitecore - Modular DXPs, which are not based on a monolithic architecture but on the assembly of decoupled components that can be used independently (or not). Often, the modular DXP does not cover the full spectrum of functionalities that monoliths have in their sights; they may lack e-commerce, analytics, or CDP depending on their positioning.

These are often a good fit for companies that want to grow with a solution without necessarily having the developing power to hand.

Examples: Ibexa, Acquia, Liferay - Business Components (PBCs): This is the space where well-known headless players operate. They address a business need in a very efficient way such as a headless CMS, PIM or DAM.

Examples: Contentful, Akineo, Commerce Tools. - Small-scope technical components. There are many vendors in this space in accordance with the SaaS nature of our industry. They are often very niche and can in many ways be regarded as the early-stage versions of the Business components solutions. They have great APIs and enable fast development and innovation as well as a very focused approach.

Examples: Niche technical products and services such as image processing, technical APIs for any service like tax calculation for instanc

Composed or De-composed?

So, what is the right route for enterprises planning to digitalize their customer-facing activities?

- Either they take a composable approach where selected components (without necessarily originating from a CMS or content repository) get integrated in a nice front-end experience

- Or they select a “pre-integrated” set of modules from a DXP vendor.

These are key considerations and are heavily discussed in our industry, by vendors and buyers alike.

Tim Bennicks from Uniform discussed this topic at the JSWorld Conference a few weeks ago, making an interesting “sandwich” analogy to explain the benefits and relevance of composing your own DXP by selecting components highly relevant for your needs just as you would make your own “customized” sandwich by choosing a tasty combination of your favorite fillings. He points out the drawback: “You’d better be a good at it!”

For me, that says it all. It is not only about the ingredients you choose for your sandwich; it is also about your ability, interest, and know-how to actually make it. Would you prefer a simpler choice between ready-made sandwiches? And by the way at what point do you stop MACHifying? Which level of granularity are you after? Do you have to also bake the bread of the sandwich?

While the analogy helps to understand the different approaches, we agree that reality is more complex. You may need much more than a sandwich, so taking the analogy further it could be that to satisfy your hunger (=requirements) you need a three - or even a five-course dinner! And here there are still more considerations. Should you buy all the ingredients and become (or hire) the chef or should you just swipe your credit card at a Michelin-starred restaurant? Obviously, it all depends on the size of your business, your level of ambition in line with your budget, the systems and teams in place already as well as your ability to develop that “perfect” DXP.

How business lock-ins come into play

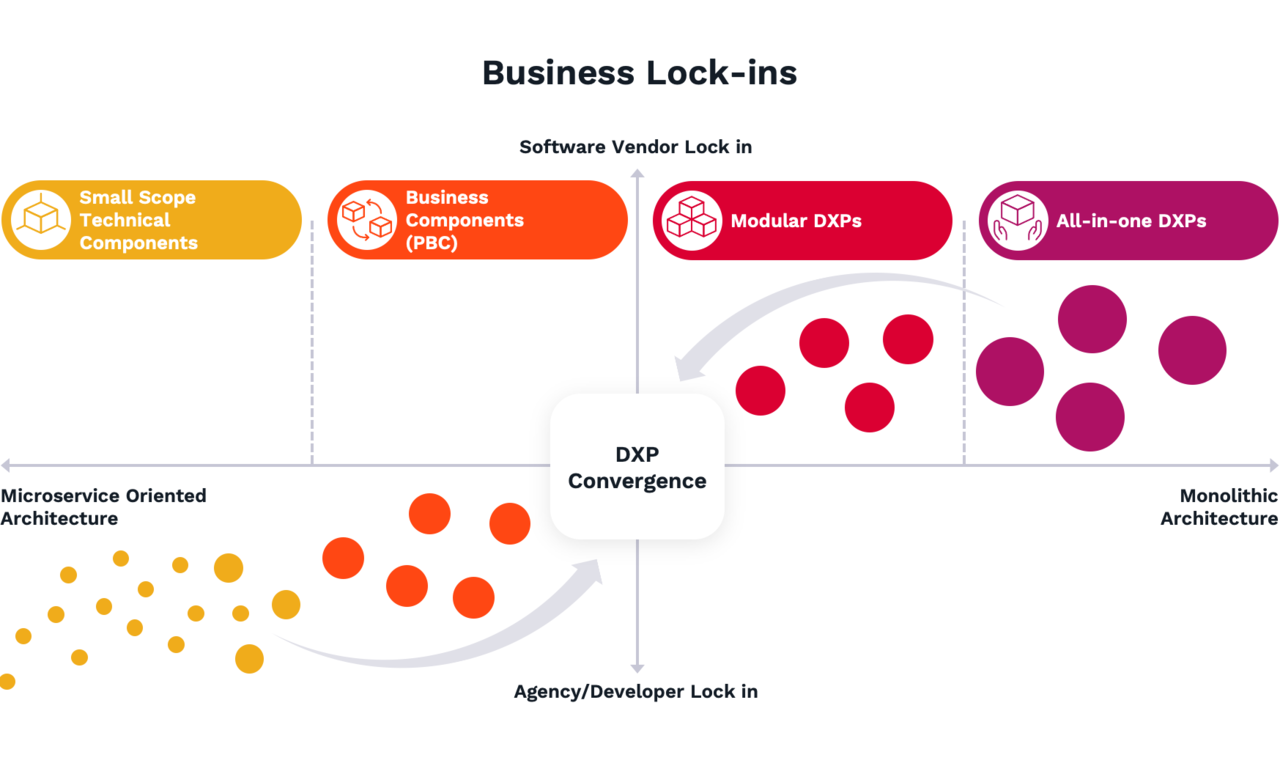

Let’s look at this from a different perspective: business lock-in. Why? Simply because business agility is a key factor of digitalization success and lock-in kills it! Lock-in here is meant in the sense of “difficulty to get out of a business relationship due to the high dependency on a third party”.

At Ibexa, Open Source is part of our DNA. The question of lock-in plays to our strengths because open technology dramatically reduces lock-in to a given piece of software. Going back to our DXP topic, we can try to imagine the lock-in dynamics in the previous diagram and ask ourselves: where does the most significant lock-in come from? Where is the highest risk of accumulating technical debt?

On the MACH side, you need to either build your own front-end team of developers or hire top-notch agencies to develop and, more importantly, maintain an experience layer which gets more and more sophisticated. This maintenance could get very complex, and you may become exposed if some key developers in-house or at your agency take their skills elsewhere.

On the DXP vendor side, you are obviously dependent on their software suites and roadmaps. You use the extensive features which means that changing your digital strategy or adapting to new market situations may be difficult.

Customer-driven dynamics

I personally believe that companies need to assess where they sit in the power balance between vendors and service providers. All too often I’ve seen customers over-relying on either a vendor (and roadmap) or integrators (and other service providers) who over-customize a solution.

If you get it right, you can rely on one or few vendor(s) (who will need to deliver over time to gain your trust in adding more components to your DXP) and work with a competent implementation partner who has the knack of building great experiences on top of the DXP without reinventing the wheel at every single request.

More and more companies on the road to digital maturity are looking for this fine balance between software vendors (having too many is also an issue) and implementation partners, which is also a reason to believe in the convergence illustrated above: a harmonious and coherent assembly of well-connected business components.

Convergence has started

For all the reasons above, I believe this convergence is highly probable. Isn’t this typical in the lifecycle of any market anyway? New solutions appear in their niche; in turn these get consolidated while the incumbents adapt to the newcomers or acquire them. And this process has already started in the DXP market.

On the headless side, the announcement a few weeks back of the acquisition of Frontastic by Commercetools is a very good illustration of how Business components might move into a modular DXP. Isn’t it the return of the head for a headless vendor?

On the DXP vendor side, the updated strategy of Sitecore and its new composable DXP built on top of new acquisitions is a clear move to become a “modular composable DXP” instead of its previous all-in-one strategy.

While DXP vendors are “MACHifying” their existing stacks, MACH players are consolidating (DXPfying) and preparing potential acquisitions. At Ibexa, we have a strong belief in an API-first, component-based DXP enabling customers and partners to accelerate development with an ideal balance between software and implementation.

Considerations for Creating Rich Customer Experiences

DXP eBook

If you are struggling with your B2B digital transformation efforts, why not reach out to us to discuss your project. Feel free to download and read Ibexa's eBook on Digital Experience Platforms and the four considerations for creating exceptional customer experiences.