How to Overcome the Challenges of Leveraging B2B Ecommerce for Complex Products

The business-to-business sector has been seen as playing catch-up almost from the moment that Jeff Bezos started selling books online out of his parents’ garage. As Amazon and eBay reinvented retail by rolling out one technological innovation after another, the pressure grew on B2B ecommerce to get its act together.

The sector was caricatured as set in its ways, hopelessly “analogue” in its cultural instincts, and fatally unaware of the digital tsunami heading its way.

The poor designs and thoughtless customer experience of the first generation of B2B ecommerce sites did nothing to change its image as the unhip younger sibling of B2C.

This label is unjust because the B2B business model is far more difficult to take online than retail. It is not that leaders were blind to the possibilities of B2B ecommerce; they were on Amazon and eBay like the rest of us. But the technology to do this for their complex products just wasn’t there.

Amazon itself understood this and steered clear of B2B for a long time. After decades of experience and innovation in B2C, the digital giant finally set up Amazon Business in 2015. It has grown at a spectacular rate since then but that is not the point; Amazon waited until it was good and ready because it knew that B2B ecommerce was an entirely different proposition from B2C.

This was not insurmountable for all B2B businesses; those that sold simple products implemented one of the eCommerce solutions that were coming on to the market. Those with more complex products deployed a Content Management System (CMS) which enabled them to at least get their catalogues online in some shape or form.

This is where many businesses still find themselves 10 or 15 years on, particularly among the German Mittelstand of successful – and highly modern – manufacturers.

They want to sell online but struggle to see how this could work with the products they have, and with the pricing and distributional infrastructures already in place. Gartner affirms this, reporting that 43% of sellers are unable to present complex products online.

In this article, we want to help B2B businesses square this circle: how can we leverage the amazing functionalities of eCommerce for our complex products?

There are many things that make a product “complex”, and we should begin not with a definition (there isn’t one) but with a description of why certain products do not lend themselves easily to B2B ecommerce.

What makes a product complex?

It is not the nature of the product that makes it immediately complex or simple. CheMondis, a marketplace for chemicals, sells highly regulated and dangerous products. Cost isn’t necessarily a factor either. According to McKinsey’s post-pandemic survey of B2B decision makers, one in three is now relaxed about spending more than $500,000 on remote or self-service channels for a single interaction.

A lot of the complexity arises from the fact that B2B businesses tend to offer products that are highly configurable at prices that can vary markedly from one distributor to the next across markets with different compliance regimes.

If we unpack that a little, it breaks down as follows:

- Product configuration. Business-to-business purchases are often part of an extended chain of production; the relationships between orders X, Y, and Z can be highly technical. What’s the role of your sales reps in a context where buyers want to be autonomous and self-reliant?

- Product catalogues. B2B businesses often sell many tens of thousands, if not hundreds of thousands, of SKUs. It is what makes configuration possible – and complex. But your B2B ecommerce initiative is dead in the water if the buyer cannot easily find the product they need as is the inevitable result if you cram a substantial product catalogue into a WordPress-type backend. Interrogating a database with hundreds of thousands, if not millions, of SKUs is source of friction for buyers interested in just part of your assortment. Custom catalogues are really a form of personalization, but a lot of B2B ecommerce tools struggle to segment the product information that they are required to handle.

- Product pricing. If you buy a content lens cleaning fluid on Amazon you pay the same price as everyone else, unless you buy 10 bottles, or take out a “subscription” (which means, effectively, that three products are on offer, each with a fixed price). But businesses have intricated contractual relationships with distributors and resellers which must be captured on the B2B ecommerce platform. This is where platforms originally built for the B2C market fall short.

- Product markets. B2B exporters are used to modifying their products to suit different markets, and so the reflex action when it came to eCommerce has usually been to create discrete sites for each of those markets (and languages). But this has led to digital drift where businesses begin to lose control of their branding and waste a lot of time updating content across many sites (and languages). None of the CMS solutions on which these satellite sites are usually built are capable of resolving this complexity. Swissport, the world’s leading provider of aviation services, turned to a next-generation Digital Experience Platform (DXP) to bring together more than 30 country sites onto a single platform, with a single backend, and a single UI.

In our next section we explore how DXPs defuse these challenges and create a path toward enablement for complex B2B eCommerce.

The route to full B2B ecommerce

Not all B2B businesses have the ambition to commit to full, transactional eCommerce. We cited the example of Swissport earlier. Its relaunched site is an indispensable resource for customers and other stakeholders, but you can’t “buy” air cargo contracts or airport fueling services off the site.

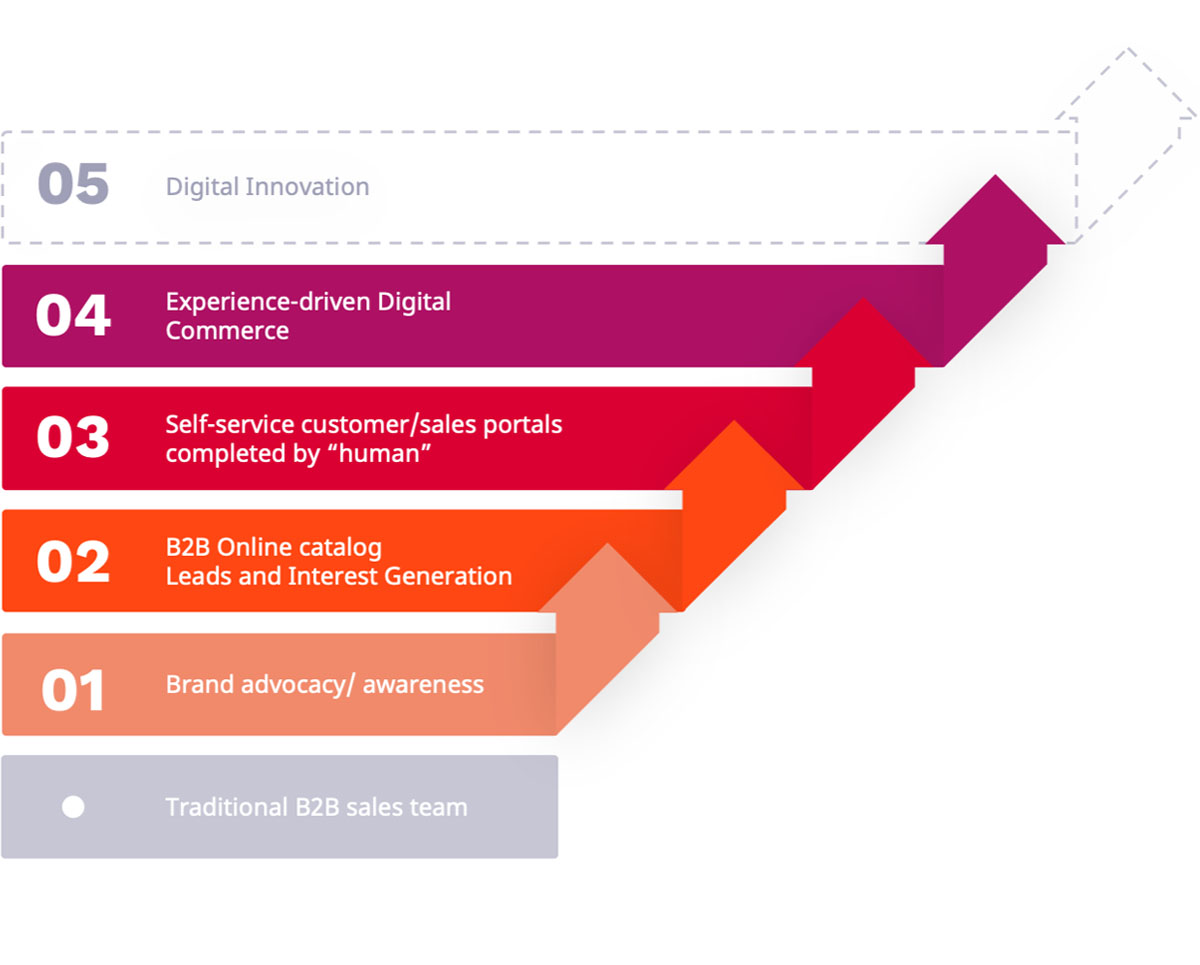

The German manufacturer of locks and security systems ABUS could easily sell a large part of its assortment directly but it made the strategic decision to stick with its established distributional model. So, in terms of the digital journey described in the graphic below, ABUS and Swissport “skip” the Digital Commerce phase (for now), but not Phase 5 that follows, Digital Innovation, because you want a DXP to be completely future proof across all use cases.

We do not have the scope here to analyze fully how this digital roadmap relates to the capabilities of your DXP. What we need to highlight for now are two things: that a lot needs to happen before a B2B business can sell its complex products online, and secondly, that you have to get there in steps – more or less as they are broken down here.

These steps towards Digital Maturity find their counterpart in the modular architecture of the so-called “composable DXP” which enables businesses to grow towards eCommerce organically, and to stagger investment in line with that technological journey. In its paper, Adopt a Composable DXP Strategy to Future-Proof Your Tech Stack[1], Gartner predicted: “By 2023, organizations that have adopted an intelligent composable approach will outpace competition by 80% in the speed of new feature implementation.”

How does a composable approach address the problems around complex B2B products and services?

As we saw, the principal pain points revolve around catalogues and pricing. Below we explore, briefly, how a composable DXP helps businesses to overcome these challenges:

- Product Information Management (PIM). DXPs with their roots in content management typically have strong backend capabilities, with some powerful enough to replace third-party PIM solutions. In addition, some vendors have added a native PIM as part of their composable offering. Businesses with extensive product catalogs deploy DXPs that have the ability to “slice up” or segment the data flexibly and powerfully to build custom catalogues for discrete customer persona. Advanced search functionalities allow customers to configure products intuitively, although there will always be a place for sales reps to add value with timely intervention in the customer experience.

- Product pricing. Integration with the core ERP system (or, in some cases, systems) feeds real-time and segmented data about price and inventory to the site. Modern standalone eCommerce solutions also allow for this, but there are a handful of DXPs on the market that give access to this do-or-die information in the research phase. It is nonsense to make price/inventory data contingent on eCommerce functionality because even the “right” product is completely wrong if it is out of stock, or not competitively priced. This capability is a significant differentiator. It should be allied with a powerful recommendation engine that presents the buyer with smart options to source the same product from a different warehouse (and with a different delivery date), or to order an alternative product at a more attractive price point.

We shall conclude by looking at two brands that are leveraging Ibexa DXP to implement B2B ecommerce for their complex products.

Case studies: Dymax and Groupe Atlantic

US manufacturer Dymax is a world leader in adhesive, coating, fluid dispensing, and light-curing systems for applications in a wide range of markets. It decided to re-platform away from WordPress which could not handle the complexity of its vast product catalogue and its presence across many markets with different regulatory regimes. A huge reason for its choice of DXP was the deal-breaking requirement to be able to plug in B2B ecommerce functionality later without the need for further development.

There is a tension in the market between DXPs that deliver great content management but rely on third-party eCommerce tools, and those that forefront eCommerce at the expense of capabilities for the creation of superb customer experiences. Dymax choose a DXP that offered the best of both worlds – in a composable package.

The main innovation of the Dymax relaunch is an intuitive product finder. In just a few clicks, customers are directed to the right industry application, the right product, and the right product formulation for the regulatory jurisdiction of the market where the product will be used. Product quotations and test sample orders are seamless extensions of this rapid and transparent search function which takes its data not from a third-party PIM but from the backend of the platform.

Groupe Atlantic is a €2 billion French manufacturer of thermal comfort solutions such as electric radiators, boilers, and heat pumps for the residential and commercial markets.

Atlantic operates many brands, and sells many products – and for some, full B2B ecommerce has been implemented.

For its Atlantic France brand, the group tackled complexity by radically segmenting content. Before it relaunched, the brand managed distinct sites for each product category, as well as a corporate portal and training site. In 2021, these sites – 10 in total – were consolidated on a composable DXP.

The “vertical” personalization of the new site created different content and customer experiences for as many as 10 personas. These are the distributors, architects, developers, and product installers that are part of the Atlantic France sales and partner network.

Previously, an installer working with a range of product categories (electric towel rails, heat pumps, air conditioning) had to go from site to site to download product specifications and installation manuals. For a distributor offering the whole Atlantic France assortment, the experience was even more fragmented.

Now this installer goes to one site for all the Atlantic products he deals with. If he clicks through to the product page of a heat pump, he will find the information he needs to fit it. But if you are a civil engineer or a developer, you will see a different product page for the same heat pump – one with the necessary facts and figures about its energy efficiency, but not its installation, because that is information these personas don’t need.

The two use cases are examples of how DXPs with end-to-end, composable capabilities are removing obstacles to full B2B ecommerce implementations for businesses with complex products. Such DXPs are a compelling choice for all B2B businesses, not only for those already planning to go transactional. Because in a context where business models and customer needs are shifting constantly, no one can afford to set limits on their future.

Conclusion

We kicked off trying to define a “complex product”. We now see that one answer to that question is: products that have outgrown their CMS and cannot be sold effectively on stand-alone eCommerce platforms. Products, in other words, that have their natural home in advanced DXPs with a clear development roadmap, focused on B2B ecommerce.

Such a roadmap must be strategically oriented towards capturing the everyday business processes that make B2B ecommerce so complex and elusive. Digital growth isn’t just for the users of DXP solutions; the vendors themselves have to continually “compose” their own transformation through the addition of new modular capabilities. These capabilities include iPaaS, a Customer Data Platform, Corporate Accounts, as well as the native PIM and Commerce modules we discussed.

In this process, the DXP widens its net to become a fit for an ever-growing number of B2B businesses struggling to sell complex products on their site(s). Implementation frontrunners such as Atlantis-DX welcome this, because it enables them to suggest Ibexa DXP as a solution for a wide range of use cases in the DACH region and beyond, as B2B ecommerce maturity becomes a realistic – and transformative – option for every B2B brand.